r&d tax credit calculator hmrc

On 17 May 2022 HMRC announced they were temporarily suspending payments of RD claims. RD tax credit calculation for profit making SMEs.

How To File A R D Research And Development Tax Credit Claim Easy Digital Filing

The tax benefit can be utilised to reduce your corporation tax bill.

. The benefit was to provide reductions or. How are RD tax credits calculated. The credit is calculated at 13 of your.

The uk governments rd tax credits scheme is designed to stimulate innovation in the uk economy. RD Tax Relief also called RD Tax Credits is a UK government subsidy that encourages businesses to invest in innovation. Select either an SME or Large.

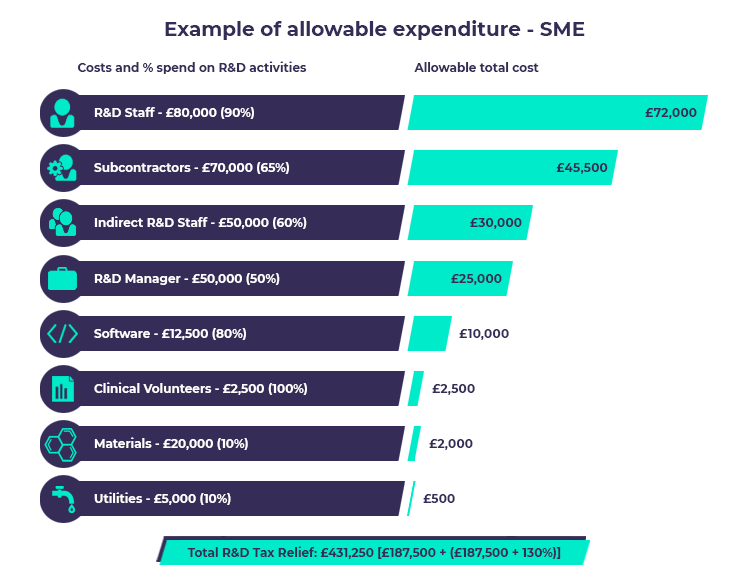

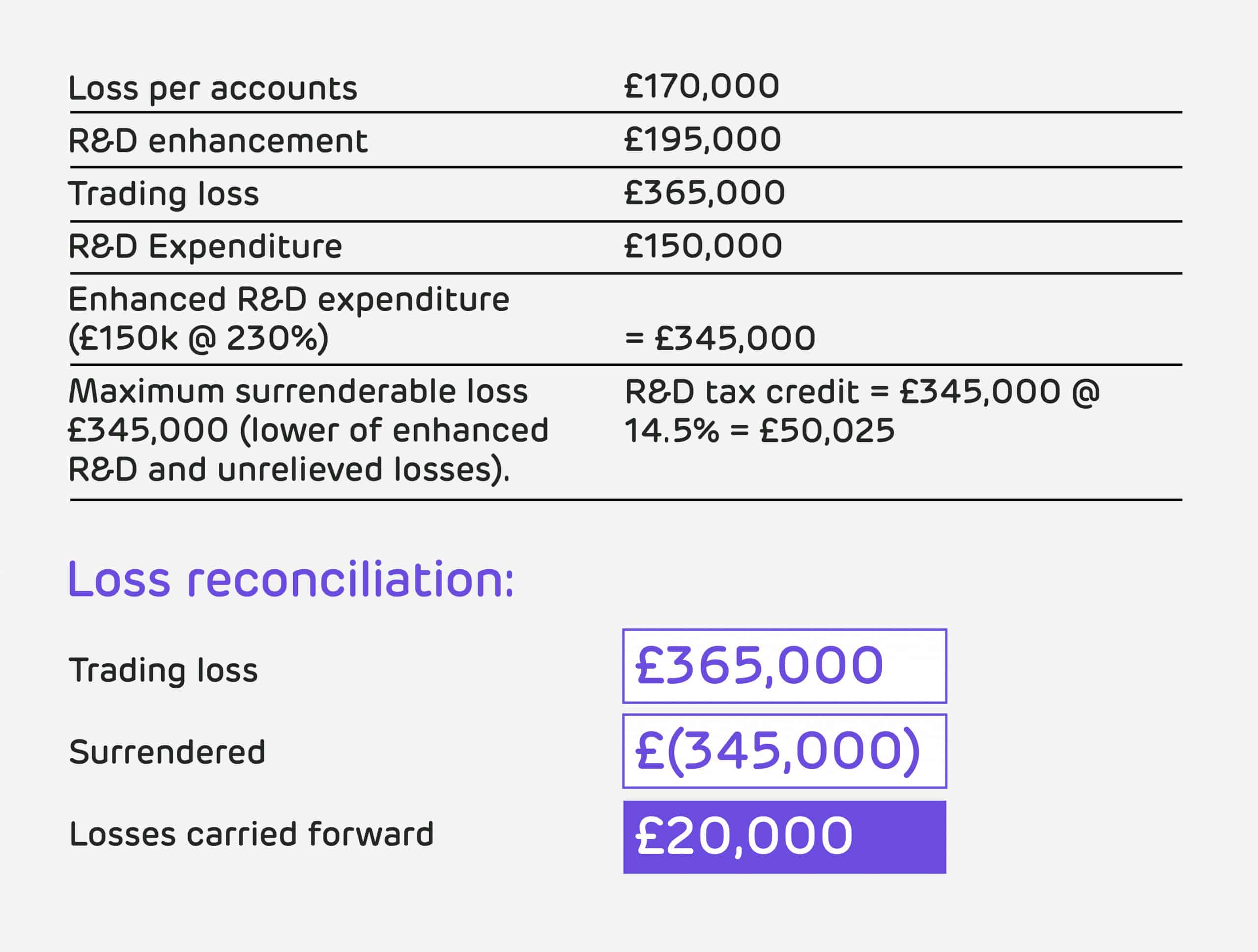

First LeedSegals needs to calculate their enhanced expenditure figure. RDEC claims are paid as a taxable credit which equates to 13 of your eligible RD costs. Put simply the scheme works by returning companies up to.

On this page you can calculate the value of your Research Development tax credits claim. The credit is calculated at 13 of your companys qualifying RD expenditure this rate applies to expenditure incurred on or after 1 April 2020 and is taxable as trading income. Use our RD tax credits calculator to get an indication of the cash benefit you can receive from claiming RD tax relief.

In general profitable SMEs can benefit from average savings of 25 so if a company. Since it launched more than 20 years. RD Tax Credits Calculator.

Our RD Tax Credit Calculator answers those questions and gives you an instant estimate of the benefit available to you. The net cash benefit after tax is 11. Just follow the simple steps below.

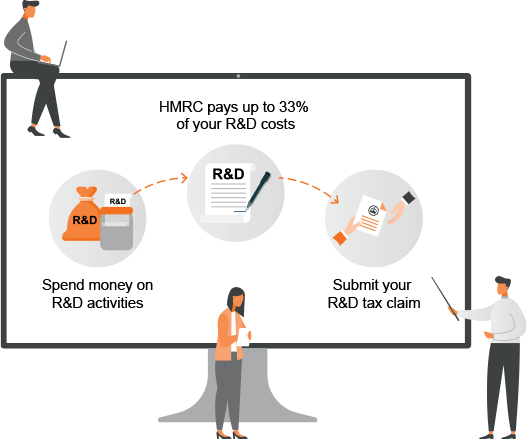

Rd tax credit calculator hmrc. HMRC tax credits are worth up to 33 of your research and development spend. According to the latest research and development RD Tax Credits Statistics Report 2018-2019 the average SME.

SMEs can claim up to 33p for every 1 spent on qualifying RD activities. The estimated total Research and Development RD tax relief support claimed for the tax year 20202021 was 66 billion This corresponds to 381 billion. If you spend money creating or improving products or services.

An RD Tax Credits specialist can save you time and money and reduce your risks of facing a lengthy HMRC investigation. All companies can deduct 100 of eligible RD. This has led to general delays across the service.

The government recently published draft legislation that documented a range of reforms to the RD tax credit scheme including the reforms to prevent abuse of the RD tax credit scheme. But they arent for everyone. The Research and Development RD Tax Credits was introduced in 2000 as a government incentive as a way to reward UK Limited Companies.

Free online RD tax credit calculator for UK based startups. LeedSegals have recently spent 100000 on software development. The calculator has been specifically developed using historic claim.

R D Tax Credit Services R D Credit For Software Development

Research Design Tax Credits Why Designers Qualify Civil Structural Engineer Magazine

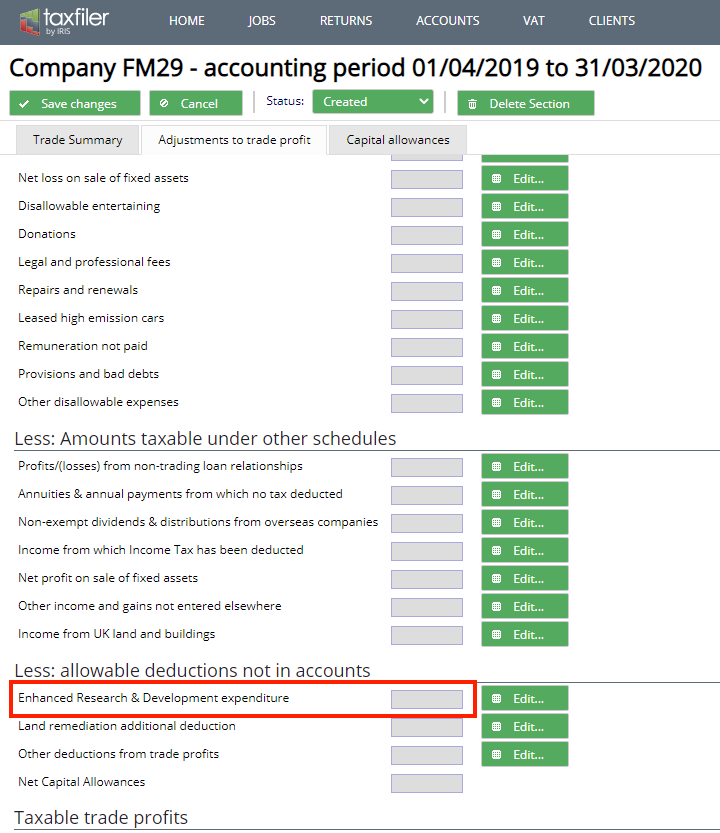

Research And Development Or Film Relief And Tax Credits Support Taxfiler

R D Tax Claims What Is R D For Tax Credit Purposes R D Tax

How To Be Proactive With R D Tax Credits Accountants Guide

How To File A R D Research And Development Tax Credit Claim Easy Digital Filing

The Importance Of Using An R D Tax Credit Software

R D Tax Credit Calculation Examples Mpa

R D Tax Claims Research And Development Tax Credit

R D Tax Credit Calculator What Is It Really Telling You Govgrant

R D Tax Credits Explained Are You Eligible What Projects Qualify

R D Tax Credits Essential Guide

R D Tax Credits Does Your Business Qualify For R D Tax Credits

R D Tax Credit Rates For Rdec Scheme Forrestbrown

Five Top Tips For Dealing With An Hmrc R D Tax Credit Enquiry Institute Of Financial Accountants