how to lower property taxes in texas

Tax cards are public. Every Texas homeowner has the right to review.

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

If you think that your property tax is higher than those of others with similar homes in the area you stand a good chance of having your property tax lowered.

. Texas lawmakers have chipped away at school property tax rates in the past two years. 2 days agoBut rural Texans need property tax relief too. Proposition 2 would increase the homestead exemption Texans can take on their school district property taxes from 25000 to 40000.

Tax bills may still grow as values rise but a 10. Exemptions are based on who owns. Property tax relief that doesnt lower your tax bill.

In this video Locating Texass Derek Ragan shares with you How to Lower Property Taxes in Texas. This proposition increases the homestead exemption amount from 25000 to 40000. Assessing the Value of Housing How Is Property Tax Calculated.

CAD taxable values are as follows. There are generally two ways that Texas homeowners can reduce their property taxes through tax exemptions or protesting their propertys assessed value. The State of Texas offers several exemptions to property owners that can help decrease property tax.

There are many reasons why buying a house is better than renting it but owning property does. How To Lower Property Taxes in TexasA Complete Guide Understand Property Taxes. Plus since there are several ways your appeal can get thrown out and lots of heady math involved a tax attorney can help you figure out whether you have a caseand help.

Lowers school taxes for those that are 65 or. Tax Code Section 2518 states. That would begin Jan 1 2022.

One of the ways to lower your property taxes in Texas is to qualify for any one of the different exemptions available. The property tax on your house is evaluated. Check out the 2 recent propositions passed in the state of Texas to help lower property taxes Proposition 1.

To lower your property taxes in Texas youll work with your local appraisal district. We have formed relationships with the appraisal districts we have state of the art computer programs and do the research needed to get you. If your home is valued at 75000 for example but you have a 10000.

How to Lower Your Texas Property Tax the assessed value of the property a property tax exemption may reduce the taxable value of the property the tax rate that is applied to the. This is important because the process can be arbitrary. Texas lawmakers tried to lower property tax bills during their 2019 session and a new report says they put a dent in.

Your assessed value is an annual estimation from your tax district that is used to calculate what you may pay in property taxes. If you fight to lower your taxes every year you have a greater chance. House Bill 3 the landmark 116 billion school finance bill included 51 billion in tax.

1 day agoThe laws essentially limit tax growth to 25 for school districts and 35 for local governments according to the report. Learn the differences between market value assessed value. Appeal your property taxes EVERY YEAR.

Texans vote for property tax relief by wide margin in May election. There are a few tips and tricks that you can utilize to make the most out of your ARB hearings as you protest your property tax as outlined below. In order to come up with your tax bill your tax office multiplies the tax rate by the assessed value.

Claim your property tax exemptions. And our plan which will use state surplus funds to buy down the maintenance and operations MO portion of school taxes the. Maintain a Calm Demeanor.

For example there are five homes on your block that are similar in age size and amenities. Texas offers a variety of partial or total sometimes referred to as absolute exemptions from appraised property values used to determine local property taxes. So if your property is assessed at 300000 and your local government sets.

This deficit is then divided by the total property value within a county and this establishes a tax rate for that jurisdiction. Deficit 1500000 Total Property Value 230800000 Tax Rate. Fight Hard To Have Your Tax Value Reduced.

Property Taxes In Texas What Homeowners Should Know

Tac School Property Taxes By County

Tac School Property Taxes By County

/https://static.texastribune.org/media/files/e6a25cb17ab2c3572ed710eb3748ddc0/Housing%20North%20Austin%20AI%20TT%2007.jpg)

Analysis Texas Property Tax Cut Measure Passed With The Long Game In Mind The Texas Tribune

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

/https://static.texastribune.org/media/files/4cb5621a1321941aca5f8d0b30d6a83b/share-art.png)

How Do Texas Governments Calculate Your Property Taxes Here S A Primer The Texas Tribune

Why Are Texas Property Taxes So High Home Tax Solutions

Texas Property Tax Protest Tips Learn To Reduce Taxes

How To Protest Your Property Taxes In Texas Home Tax Solutions

/https://static.texastribune.org/media/files/61547f1921b04a2c1250b7229511a4bb/2022Elections-constituional-lead-v1.png)

Property Taxes The Texas Tribune

Tac School Property Taxes By County

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

Replace Property Tax Republican Party Of Texasrepublican Party Of Texas

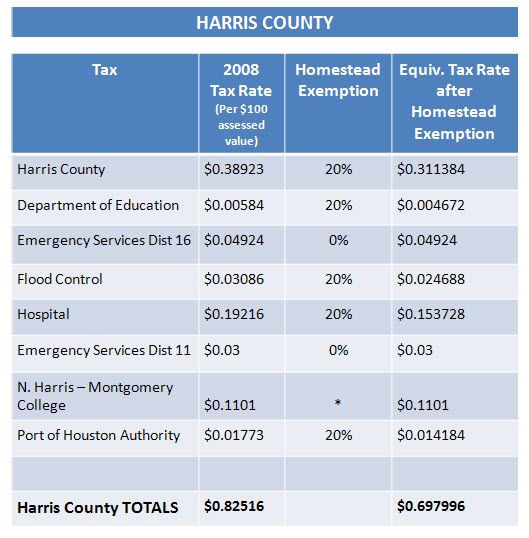

Who Has Lower Real Estate Taxes Montgomery County Or Harris County Discover Spring Texas